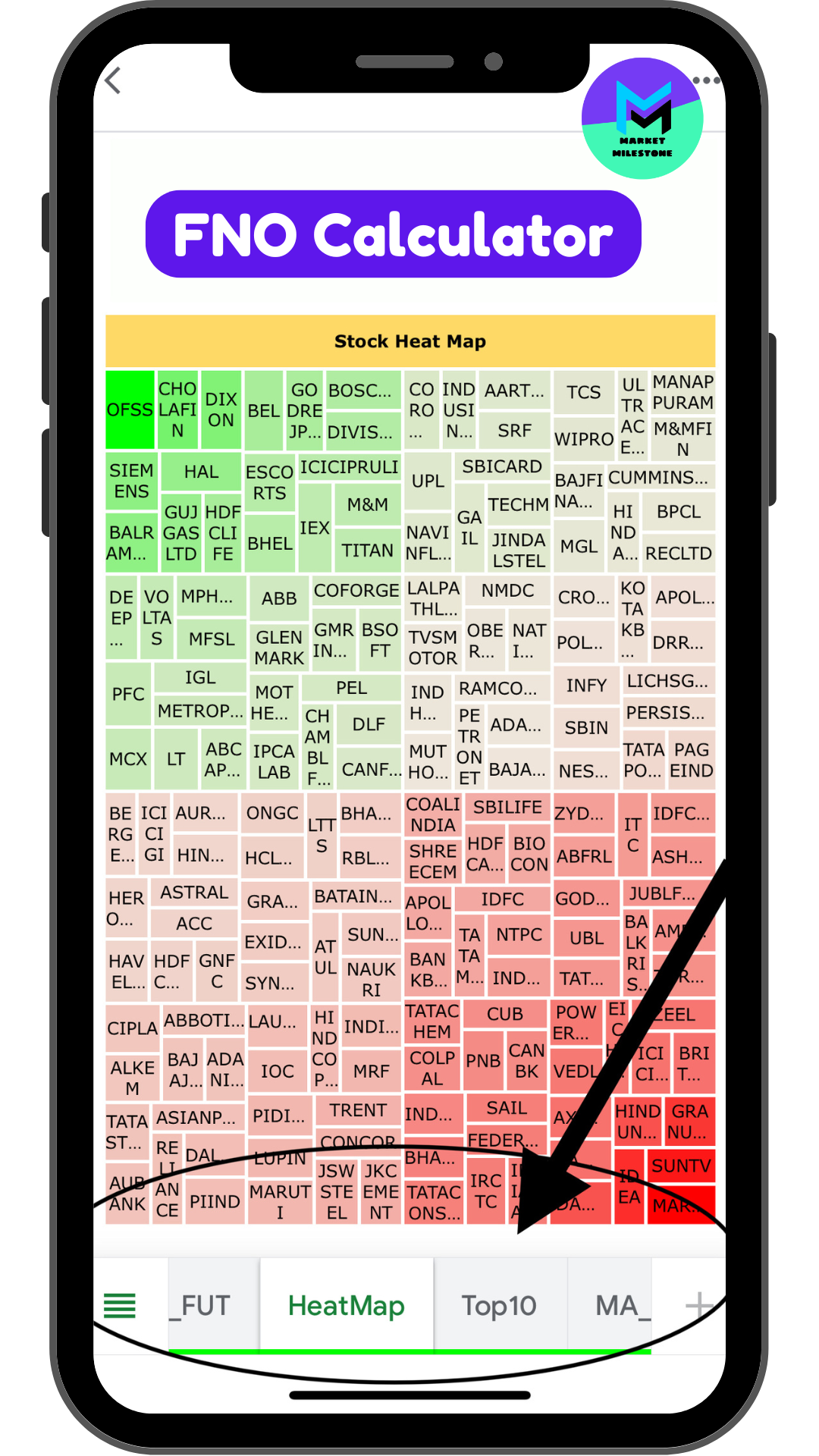

Share Market Crashes: How to Analyze Top 10 Gainers and Losers with the FNO Calculator

Market crashes are an inevitable aspect of the stock market’s cyclical nature. While they can be unsettling, they also present unique opportunities for traders who know where to look. Analyzing the top 10 gainers and losers during a crash can offer valuable insights into market sentiment and trading opportunities. When combined with the FNO Calculator, this analysis becomes even more powerful. Let’s explore how to navigate market crashes effectively by focusing on gainers, losers, and the FNO Calculator.

What Happens During a Share Market Crash?

A share market crash is a sudden, steep decline in stock prices across major indices. It is often triggered by events such as economic recessions, geopolitical tensions, or overvalued stocks correcting themselves. Market crashes result in heightened volatility and widespread sell-offs, but they also highlight which sectors and stocks remain resilient.

Key Characteristics of a Market Crash:

- High Volatility: Rapid and unpredictable price movements.

- Increased Trading Volume: A surge in trading activity as panic sets in.

- Sector Rotation: Shifts in investment from high-risk to defensive sectors.

The Role of Top 10 Gainers and Losers in a Crash

During a crash, top gainers and losers offer crucial insights:

Top Gainers

- Definition: Stocks that record the highest percentage gains despite the broader market decline.

- What They Indicate: Resilient sectors, strong fundamentals, or investor confidence in specific stocks.

Top Losers

- Definition: Stocks that suffer the largest percentage declines.

- What They Indicate: Weak fundamentals, overvaluation, or sectors most impacted by the crash.

Why Analyzing Gainers and Losers Matters

- Understand Market Sentiment

The proportion of gainers versus losers reveals whether the market sentiment is overwhelmingly bearish or if pockets of optimism exist.

- Spot Resilient Sectors

Gainers often belong to defensive sectors like healthcare or utilities, while losers might be concentrated in cyclical sectors like technology or real estate.

- Identify Trading Opportunities

Gainers and losers highlight stocks worth considering for short-term trades or long-term investment opportunities.

How the FNO Calculator Enhances Analysis

The FNO Calculator simplifies complex futures and options calculations, enabling traders to craft effective strategies based on real-time data. By integrating insights from gainers and losers, the FNO Calculator becomes an invaluable tool during market crashes.

Key Features of the FNO Calculator:

- Profit and Loss Analysis: Evaluate potential outcomes for selected trades.

- Break-Even Points: Determine the price levels at which trades become profitable.

- Margin Requirements: Calculate the funds required to execute trades.

- Scenario Simulations: Assess the impact of market changes on trade outcomes.

How to Analyze Top 10 Gainers and Losers with the FNO Calculator

Step 1: Identify the Top Gainers and Losers

Refer to financial platforms or stock exchange websites to access daily lists of top 10 gainers and losers. Focus on stocks with significant percentage changes and trading volume.

Step 2: Group Stocks by Sector

Categorize the gainers and losers by sector to identify sectoral trends. This helps in understanding which industries are leading or lagging during the crash.

Step 3: Input Data into the FNO Calculator

For selected stocks, input trade-specific parameters such as:

- Strike Price

- Premium

- Lot Size

- Expiry Date

Step 4: Simulate Market Scenarios

Use the calculator’s scenario simulation feature to predict how changes in price, volatility, or time decay affect trade outcomes.

Step 5: Develop a Trading Strategy

- For top gainers, consider bullish strategies like buying call options or taking long positions.

- For top losers, evaluate bearish strategies such as buying put options or short-selling.

Practical Applications of the FNO Calculator

- Risk Management

Identify potential losses and set stop-loss orders to mitigate risks.

- Hedging Strategies

Use the FNO Calculator to design strategies that protect your portfolio from further declines.

- Capitalizing on Volatility

Analyze gainers and losers with the calculator to exploit heightened market volatility effectively.

- Portfolio Rebalancing

Identify resilient stocks among gainers for potential addition to your portfolio.

Tips for Effective Analysis During Market Crashes

- Stay Updated: Monitor news and macroeconomic indicators driving market trends.

- Focus on Liquidity: Prioritize stocks with high trading volume for easier execution.

- Combine Tools: Pair the FNO Calculator with technical analysis tools like RSI or moving averages.

- Set Clear Goals: Define profit targets and risk thresholds before trading.

Final Thoughts

Market crashes are challenging but offer unique opportunities for traders who know how to analyze data effectively. By focusing on the top 10 gainers and losers and leveraging the FNO Calculator, you can craft well-informed strategies to navigate volatility and capitalize on market movements.

Ready to enhance your trading strategy? Start analyzing top gainers and losers with the FNO Calculator today and take your trading decisions to the next level.

Add a comment Cancel reply

Categories

- FNO Excel (2)

- Market Milestone (2)

- Sector Heat Maps (1)

- Top 10 Stock (1)

Recent Posts

About us

Your Financial Milestone

with its super power, perfect financial appetite, Market Milestone gets you great stocks analysis, action packed calculator and learning on the go.